Table of Contents

Toggle Do you need to set aside a bankruptcy notice?

Do you need to set aside a bankruptcy notice?

Non-compliance with a bankruptcy notice results in the debtor committing an “act of bankruptcy”.

An act of bankruptcy is one of the prerequisites to presenting a creditor’s petition in the Federal Circuit Court.

You have three (3) options if you are served with a bankruptcy notice, they are:

- Pay to the creditor the amount of the debt; or

- Make an arrangement to the creditor’s satisfaction for settlement of the debt; or

- Apply to set aside the bankruptcy notice.

Our bankruptcy lawyers explain how to set aside a bankruptcy notice, and gives you a complete guide on the procedure for setting the bankruptcy notice aside.

DEDICATED FOCUS – COMMERCIALLY MINDED – PROVEN RESULTS

OR CALL: 1300 545 133 FOR A PHONE CONSULTATION

What is Required for a Bankruptcy Notice?

To understand whether or not you can set aside a bankruptcy notice, you will first need to understand the requirements for a bankruptcy notice.

Section 41 of the Bankruptcy Act 1966 (Cth) (“Bankruptcy Act”) says:

(1) An Official Receiver may issue a bankruptcy notice on the application of a creditor who has obtained against a debtor:

(a) a final judgment or final order that:

(i) is of the kind described in paragraph 40(1)(g); and

(ii) is for an amount of at least the statutory minimum; or

(b) 2 or more final judgments or final orders that:

(i) are of the kind described in paragraph 40(1)(g); and

(ii) taken together are for an amount of at least the statutory minimum.

Section 40(1)(g) of the Bankruptcy Act describes the judgment debt as:

final judgment or final order, being a judgment or order the execution of which has not been stayed

A final decision of the QCAT, which is also a monetary decision, that has also been filed in the registry of a court of competent jurisdiction (in accordance with section 131 of the Queensland Civil and Administrative Tribunal Act 2009) is a “final judgment or final order” for the purposes of section 41(1) of the Bankruptcy Act.

In Ferris v Queensland Building and Construction Commission [2015] FCCA 176 the applicant in an application attempting to set aside a bankruptcy notice on three (3) grounds, one of which was that the respondent did not have a final judgment or a final order against the applicant for the purposes of ss.40(1)(g) and 41 of the Bankruptcy Act.

Ferris argued that the UCPR Form 1 and the QCAT decision it was attached to, were not final judgments or final orders, and applied to set aside a bankruptcy notice.

The Judge Jarrett said:

The focus in this case on s.131 of the Act has been apt to distract from the more important question, namely whether a final decision of QCAT is, of itself, a final judgment or final order for the purposes of ss.40(1)(g) and 41 of the Bankruptcy Act. In my view they are either a final judgment or final order for the purposes of ss.40(1)(g) and 41 of the Bankruptcy Act. I do not need to decide which.

The application to set aside the bankruptcy notice was dismissed with costs.

So, a bankruptcy notice is founded on a final judgment or final order (which includes a registered QCAT decision) for $10,000.00 or more, the execution of which has not been stayed.

Section 41(3) of the Bankruptcy Act then says:

A bankruptcy notice shall not be issued in relation to a debtor … in respect of a judgment or order for the payment of money if … a period of more than 6 years has elapsed since the judgment was given or the order was made

So, the final judgment or final order cannot be older than six (6) years old.

Finally, section 41 of the Bankruptcy Act says:

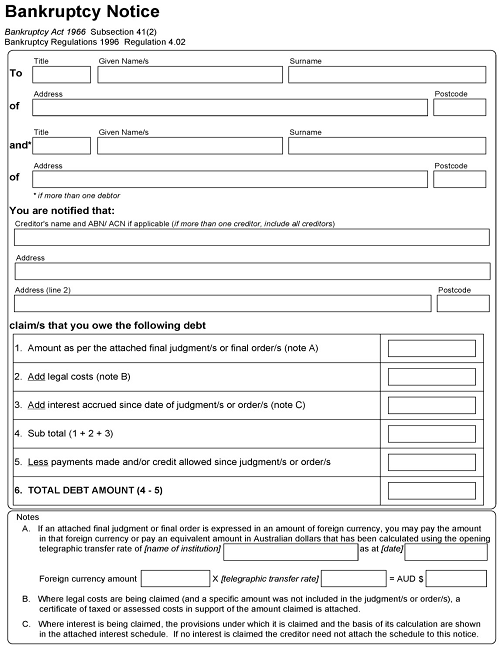

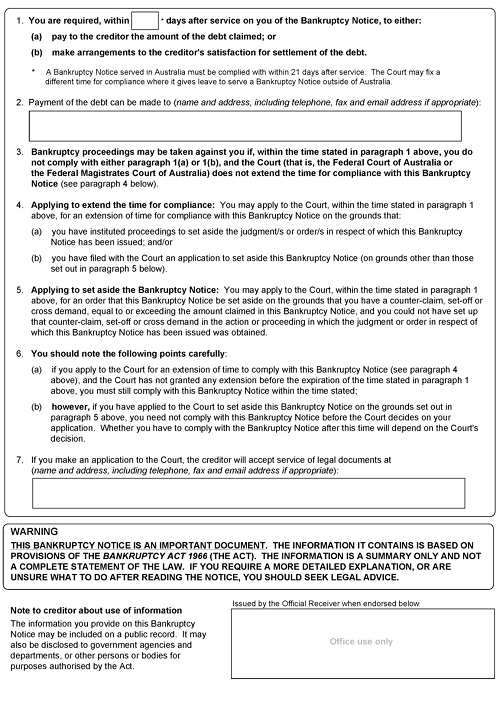

The notice must be in accordance with the form prescribed by the regulations.

Regulation 4.02 of the Bankruptcy Regulations 1996 (Cth) (“Bankruptcy Regulations”) says:

4.02 Form of bankruptcy notices

(1) For the purposes of subsection 41(2) of the Act, the form of bankruptcy notice set out in Form 1 is prescribed.

(2) A bankruptcy notice must follow Form 1 in respect of its format (for example, bold or italic typeface, underlining and notes).

The Form 1 is contained in schedule 1 of the Bankruptcy Regulations. See the bottom of this article for the Form 1 Bankruptcy Notice.

We will now discuss how to set aside a bankruptcy notice.

Application to Set Aside a Bankruptcy Notice

Rule 3.02 of the Federal Court (Bankruptcy) Rules 2016 (Cth) (“Bankruptcy Rules”) says:

(1) An application to set aside a bankruptcy notice under the Bankruptcy Act must be accompanied by an affidavit stating:

(a) the grounds in support of the application; and

(b) the date when the bankruptcy notice was served on the applicant.

(2) A copy of the bankruptcy notice must be attached to the affidavit.

The Application form to set aside a bankruptcy notice is the Form B2

The Affidavit to set aside a bankruptcy notice is the Federal Circuit Court Affidavit

Filing Fees for Federal Circuit Court Application

The application in the Federal Circuit Court for an application to set aside a bankruptcy notice are found on the Federal Circuit Court website. The current fee (at the time of writing this article is $1,565.00.

We strongly advise engaging a bankruptcy solicitor if you want to make an application to set aside the bankruptcy notice, to increase your chances of success, and avoid adverse costs orders if you are unsuccessful.

How to Set Aside a Bankruptcy Notice

There are four (4) main grounds to set aside a bankruptcy notice, they are:

- There is a defect in the notice; and/or

- The judgment debt allowing the notice is disputed; and/or

- The debtor has a cross-demand, set-off, or counterclaim which is equal to, or more than the judgment debt; and/or

- The notice is an abuse of process.

I will explain these grounds in more detail below.

Defect in the Bankruptcy Notice

Bankruptcy notices are issued directly from the Australian Financial Security Authority (“AFSA”). When applying to AFSA for a bankruptcy notice, you will have to ensure that everything is correct, because a bankruptcy notice can be set aside if it contains a defect.

However, section 306 of the Bankruptcy Act says:

Proceedings under this Act are not invalidated by a formal defect or an irregularity, unless the court before which the objection on that ground is made is of opinion that substantial injustice has been caused by the defect or irregularity and that the injustice cannot be remedied by an order of that court.

So, as in a defect in a statutory demand, a defect in a bankruptcy notice will only allow the notice to be set aside, if substantial injustice has been caused.

In Kleinwort Benson Australia Ltd v Crowl [1988] HCA 34 the High Court of Australia said:

The authorities show that a bankruptcy notice is a nullity if it fails to meet a requirement made essential by the Act, or if it could reasonably mislead a debtor as to what is necessary to comply with the notice

They reversed the previous decision in Australian Steel Company (Operations) Pty Ltd v Lewis [2000] FCA 1915 and said that a bankruptcy notice may not be set aside if the defect was “formal” rather than “substantive“. To be substantive, the High Court said that the defect be:

objectively capable of misleading the debtor as to what is necessary for compliance with the notice

In Adams v Lambert (2006) 228 CLR 409 the High Court of Australia said:

The composite expression “a formal defect or an irregularity”, in its application to a bankruptcy notice, conveys a meaning with elements of both inclusion and exclusion.

So a defect can be something which is in the notice but should not be, or something which is not in the notice that should be. Also, it must include essential requirements and must not mislead or confuse a judgment debtor.

Types of Defects in a Bankruptcy Notice

Failure to attach the judgment

In Curtis v Singtel Optus Pty Ltd & Anor [2014] FCCA 1286 the judgment debtor applied to have the notice set aside as the judgment did not “attach” judgment/order founding the notice. Judge Lloyd-Jones of the Federal Circuit Court followed a long line of precedents and said:

Reg. 4.02(2) provides that the bankruptcy notice must follow Form 1 in respect of its format but that regulation is not to be taken as expressing an intention contrary to section 25C of the Acts Interpretation Act. Thus, despite the use of the word “must” in regulation 4.02(2) strict compliance with Form 1 is not required.

… The application should be dismissed with costs awarded to the respondents.

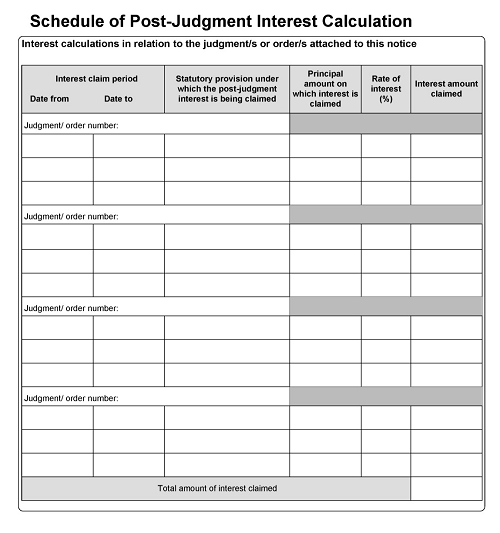

Incorrect legislative provision for interest calculation

In Australian Steel Company (Operations) Pty Ltd v Lewis [2000] FCA 1915 the applicant alleged that because the prescribed form requires statement of provision under which interest claimed, incorrectly naming that provision allows for the bankruptcy notice to be set aside. In their joint decision Black CJ, Heerey and Sundberg JJ said:

Could it be said that incorrect citation of the statute that prescribed that interest was payable by the debtor on a judgment debt could mislead the debtor as to the steps to be taken by the debtor to comply with the notice? The answer, obviously, is no … The bankruptcy notices are not invalid and the petitions must be set down for further hearing.

Incorrect calculation for Interest

Section 41(5) of the Bankruptcy Act says:

A bankruptcy notice is not invalidated by reason only that the sum specified in the notice as the amount due to the creditor exceeds the amount in fact due, unless the debtor, within the time allowed for payment, gives notice to the creditor that he or she disputes the validity of the notice on the ground of the misstatement.

In Miao v Owners Corporation SP 31235U [2015] FCA 352 Beach J said:

Even if there was an error made in the interest calculations as claimed in the bankruptcy notice, in my view, such a defect would not invalidate the bankruptcy notice. Section 41(5) makes this clear (there was no notice at the relevant time), as does s 306 of the Act.

Misspelling of a Debtor in the Bankruptcy Notice

In Matheson v Scottish Pacific Business Finance Pty Ltd [2005] FCA 670 Kiefel J said:

Mr Matheson has referred me to the definition of ‘legal name’ in Black’s Law Dictionary … as ‘a person’s full name as recognised in law’. That does not however mean that a court document such as a bankruptcy notice or petition is void if the full legal name of the person is not provided. There is no doubt that Mr Matheson is the person named in the District Court proceedings and in these proceedings and that he has understood that to be the case. He has represented himself and appeared. There was no ambiguity created by the bankruptcy notice or petition. In any event if there was an irregularity in the mode of description, it is of a formal nature and one that can be validated by s 306(1) of the Bankruptcy Act … In my opinion, the petition notice does not cause any injustice as it was not likely to mislead the debtor.

Creditor’s Solicitor as the Address for Payments

In E A Pugliese v The Chase Manhattan Bank Australia Limited [1993] FCA 454 Heerey J said:

The requirement of providing the address of the creditor was satisfied in this case by giving the address of the creditor’s solicitors, since that was a place where payment of the debt would be accepted, even though it was not a place where the creditor carried on business.

PO Box is not an address for service

In David Sarikaya v Victorian Workcover Authority [1997] FCA 1372 Black CJ said:

A post office box is not, in my view, the “address of a place” at which a document may be “left” for a person … Whether or not such a box is, in this context, the “address of a place”, it is not the address of a place at which a document may be “left” by way of service.

Others examples include:

James v Federal Commissioner of Taxation [1955] HCA 75 where a notice wrongly sought to restrict the debtor to paying debt to creditors at one particular place.

Re Gyngell; Ex parte Speedo Group Limited (1990) 27 FCR 531 where the notice contained the incorrect requirement that judgment debt be paid to Registrar of Local Court.

Re Beauchamp; Ex parte Beauchamp [1904] 1 KB 572 where the bankruptcy notice included the wrong address of creditor.

Re Celestine; Ex parte Monte Paschi Australia Ltd (1997) 71 FCR 399 where the bankruptcy notice contained the incorrect address of court.

As well as the bankruptcy notice being set aside for being defective, a notice can also be set aside if the judgment debt is disputed.

The Judgment Debt is Disputed

A judgment debt is disputed by either:

- Paying the debt; or

- Applying to set aside the judgment or order which the bankruptcy notice is based on.

Section 41(6A) of the Bankruptcy Act says:

(6A) Where, before the expiration of the time fixed for compliance with the requirements of a bankruptcy notice:

(a) proceedings to set aside a judgment or order in respect of which the bankruptcy notice was issued have been instituted by the debtor; or

(b) an application has been made to the Court to set aside the bankruptcy notice;

the Court may, subject to subsection (6C), extend the time for compliance with the bankruptcy notice.

Section 41(6C) of the Bankruptcy Act says:

(6C) Where:

(a) a debtor applies to the Court for an extension of the time for complying with a bankruptcy notice on the ground that proceedings to set aside a judgment or order in respect of which the bankruptcy notice was issued have been instituted by the debtor; and

(b) the Court is of the opinion that the proceedings to set aside the judgment or order:

(i) have not been instituted bona fide ; or

(ii) are not being prosecuted with due diligence;

the Court shall not extend the time for compliance with the bankruptcy notice.

So, in an application to set aside, or extend time for compliance, the application to set aside the judgment must have been filed in the correct Court, and the affidavit material must raise genuine and arguable grounds for a defence which must have sufficient prospects of being successful.

Applications under this section cannot be made simply for the purpose of stalling the bankruptcy proceedings.

A judgment debtor may also have a cross-demand, set-off, or counterclaim.

Cross-demand, Set-off, or Counterclaim

Section 40(1)(g) of the Bankruptcy Act says in relation to a judgment, a debtor who can:

… satisfy the Court that he or she has a counter-claim, set-off or cross demand equal to or exceeding the amount of the judgment debt or sum payable under the final order, as the case may be, being a counter-claim, set-off or cross demand that he or she could not have set up in the action or proceeding in which the judgment or order was obtained …

Rule 3.02(3) of the Federal Court (Bankruptcy) Rules 2016 says:

If the application is based on the ground that the debtor has a counter-claim, set-off or cross demand referred to in paragraph 40(1)(g) of the Bankruptcy Act, the affidavit must also state:

(a) the full details of the counter-claim, set-off or cross demand; and

(b) the amount of the counter-claim, set-off or cross demand and the amount by which it exceeds the amount claimed in the bankruptcy notice; and

(c) why the counter-claim, set-off or cross demand was not raised in the proceedings that resulted in the judgments or orders to which the bankruptcy notice relates.

To satisfy this section of the Bankruptcy Act, the counter-claim, set-off or cross demand must:

- Be equal to or exceed the amount of the judgment debt or sum payable under the final order; and

- Why it could not have set up in the action or proceeding in which the judgment or order was obtained; and

- Annex all of this evidence in an application to set the bankruptcy notice aside.

The relevant legal principles are contained in the case law.

In Guss v Johnstone [2000] HCA 26 the High Court of Australia said:

The state of satisfaction referred to in s 40(1)(g), and s 41(7), involves weighing up considerations as to the legal and factual merit of the claim relied upon by the debtor, and the justice of allowing the bankruptcy proceedings to go ahead or requiring them to await the determination of the claim.

In Vogwell v Vogwell (1939) 11 ABC 83 the Court decided that:

The offsetting claim must sound in money and it must be a claim that it is proper and reasonable for the debtor to litigate

In Ebert v Union Trustee Company of Australia Ltd [1960] HCA 50 the High Court considered the necessity for cross demand to be in same right (as trustee for example). The High Court of Australia said:

These considerations are enough to show in detail why it is that the appellant debtor does not possess a cross demand against the respondent trustee company.

In Glew v Harrowell, in the matter of Glew [2003] FCA 373 Lindgren J summarized it perfectly by saying that the Court must be satisfied of the following interrelated and sometimes overlapping matters:

- They have a “prima facie case”; and

- They have “a fair chance of success” or are “fairly entitled to litigate” the claim; and

- They are advancing a “genuine” or “bona fide” claim.

Even if a judgment debtor cannot safisfy the requirements of the three (3) ways to set aside a bankruptcy notice mentioned above, the issuance of the bankruptcy notice may still be an abuse of process.

The Bankruptcy Notice is an Abuse of Process

In Lindholdt v Merritt Madden Printing Pty Ltd [2002] FCA 260 Weinberg J said:

It has been held that this Court can set aside a Bankruptcy Notice as an abuse of process in the exercise of its inherent jurisdiction … For example, if it is apparent that the purpose of a Bankruptcy Notice is to put pressure on a debtor to pay a debt rather than to invoke the Court’s insolvency jurisdiction, then the filing of the Bankruptcy Notice is itself an abuse of process.

It has been determined that an abuse of process usually falls into one of three categories succinctly outlined in Rogers v R [1994] HCA 42 following HWY Rent Pty Ltd v HWY Rentals (in liq) (No.2) [2014] FCA 449 when Judge Antoni Lucev said the three categories are:

- The Court’s procedures are invoked for an illegitimate purpose; and/or

- The use of the Court’s procedures is unjustifiably oppressive to one of the parties; and/or

- The use of the Court’s procedures would bring the administration of justice into disrepute.

In Williams v Spautz [1992] HCA 34 the High Court of Australia said that an abuse of process is:

when the purpose of bringing the proceedings is not to prosecute them to a conclusion but to use them as a means of obtaining some advantage for which they are not designed

In Yarranova Pty Ltd v Shaw (No 2) [2014] FCA 616 Gordon J summerised the applicable principles:

There is a heavy onus on the person alleging the abuse of process. In any particular case, whether there is a use of the process or an abuse of it depends upon the purpose rather than the result … To establish abuse of process, more than mere assertion is required … It is an abuse of process for a judgment creditor to pursue bankruptcy proceedings “for the purpose of stifling litigation” … So, for example, if the purpose of the bankruptcy notice is to put pressure on a debtor to pay a debt rather than to invoke the Court’s jurisdiction in relation to insolvency, then the filing of a bankruptcy notice is an abuse of process.

Set aside a Bankruptcy Notice Summary

If you want to set aside a bankruptcy notice, you will need to prove:

- There is a defect in the notice; and/or

- The judgment debt allowing the notice is disputed; and/or

- The debtor has a cross-demand, set-off, or counterclaim which is equal to, or more than the judgment debt; and/or

- The notice is an abuse of process.

If you cannot, then it is unlikely that the bankruptcy notice will be set aside.

If you are unable to set this aside, then you may be able to annul your bankruptcy.

DEDICATED FOCUS – COMMERCIALLY MINDED – PROVEN RESULTS

OR CALL: 1300 545 133 FOR A PHONE CONSULTATION

Bankruptcy Notice Form 1

DEDICATED FOCUS – COMMERCIALLY MINDED – PROVEN RESULTS

OR CALL: 1300 545 133 FOR A PHONE CONSULTATION